The liquidation of Chinese property developer, Evergrande, has the potential to alter the trajectories of many electric car manufacturers in a classic ‘butterfly effect’ situation.

Chinese property development has been the largest consumer of iron ore, manganese and nickel – all used in the production of steel.

Analysts have already started running the numbers on what the demise of debt-laden Evergrande (and potentially other Chinese developers) could have on the commodity sector. Already facing subdued growth, forecasters will be looking at what effect this might have on demand, stockpiles and pricing for a number of steel input commodities.

Nickel’s woes have been laid bare in the past month or two with a number of Australian nickel miners looking to shutter their operations on the back of low prices caused by slowing demand and a surge in low-cost production out of Indonesia. Many industry players thought that Indonesia’s lateritic ores wouldn’t substitute for high grade nickel sulphide ore, however that turned out not to be the case.

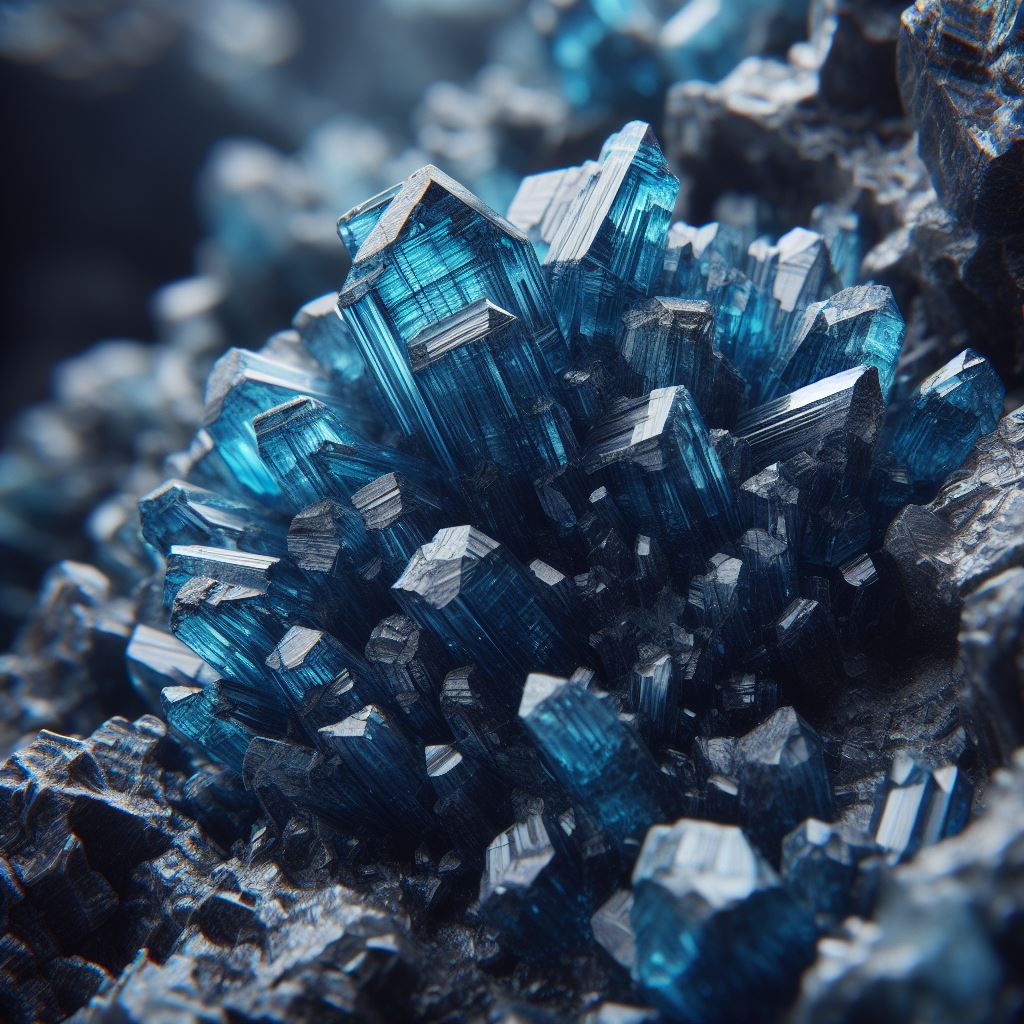

Manganese use is currently dominated by the steelmaking sector, accounting for approx. 90% of demand. A smaller, but increasingly important component of demand, is taken up by the use of manganese in cathodes for EV batteries.

In many ways, manganese is one of the most important parts of the battery. By pure volume alone, manganese is one of the largest parts of the battery cathode in most of the chemistries used today, varying between 8% and 29%. Increasing EV sales has seen manganese use in batteries continue to increase, with Benchmark Mineral Intelligence forecasting an 8x increase in manganese from EV demand between 2020 and 2030.

For current and emerging manganese producers, tapping into the growth part of the market seems like a no brainer. However, as with many commodities (including iron ore and nickel), not all ores are the same and many are not suitable for EV use.

For manganese, the key chemistry being sought is high-purity manganese sulphate monohydrate (HPMSM), where – surprise, surprise – production is dominated by China. The production of HPMSM is a relatively complex multistage purification process with leaching, precipitation and refining all required to increase the grade and reduce impurities. It is the level and type of impurities that largely determines if the deposit is suitable to be developed as a HPMSM focused product.

So, how do we join the dots between Evergrande’s failure and the outlook for electric car manufacturers?

Lower steel consumption in China means that they will likely need less steel inputs (iron ore, manganese, titanium etc).

In a market already in surplus, this is likely to result in higher stockpiles and downward pressure on prices.

A lower manganese concentrate price has the potential to curtail new developments or expansions.

Where lower cost Indonesian nickel was able to substitute for higher cost nickel sulphides, it doesn’t appear as likely that there will be a big shift for the manganese producers (due to the ore chemistry issues noted above).

A potential scenario is flat or declining manganese supply in a period when battery makers are forecasting a potentially 8x increase in EV demand. We could see a situation where manganese concentrate prices decline but there is strengthening in the HPMSM price.

Which of course has an impact on the cost of batteries for electric car makers.

The intricate balance of commodity dynamics now poses a serious challenge to the cost structure of EV manufacturers, underscoring the intricate interconnectedness of seemingly disparate industries.

Photo credit: Photo by Tom Radetzki

White Noise communications is provided a fee for service working with companies which may have exposure to commodities or securities mentioned in these articles. All articles are the opinion of the author and are not endorsed by, or written in collaboration with, our clients.