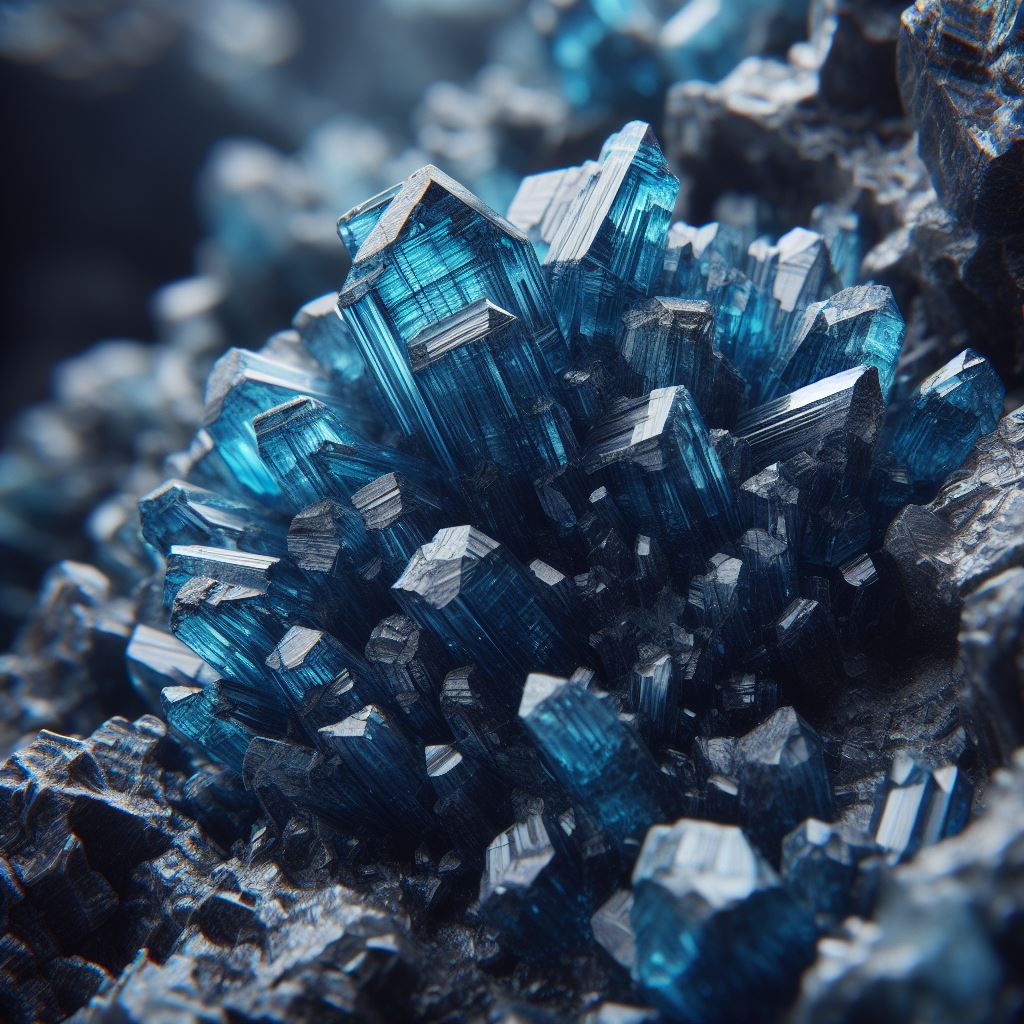

In the world of commodities, there’s a blue metal that’s capturing the attention of savvy investors worldwide – cobalt. This lustrous, silvery-blue metal is more than just a pretty face. It’s a critical component in the burgeoning electric vehicle (EV) industry and a key player in the global energy transition.

The demand for cobalt has been on an upward trajectory, primarily driven by its use in lithium-ion batteries, which power everything from smartphones to electric vehicles. The EV revolution, in particular, has put cobalt in the spotlight. As automakers worldwide race to electrify their fleets, the demand for cobalt, a crucial ingredient in EV batteries, is set to skyrocket.

On the supply side, things are a bit more complicated. Over 73% of the world’s cobalt supply comes from the Democratic Republic of Congo (DRC), a country plagued with political instability and ethical mining issues.

The DRC, despite its rich cobalt reserves, is a hotbed of controversy. The mining sector is riddled with challenges, from child labour to unsafe working conditions. It is estimated that ~20% of DRC production of cobalt comes from small-scale artisanal mines that rely on child labour. These issues have led to increased scrutiny from human rights organisations and governments, putting pressure on companies to source cobalt responsibly.

Next in line is Indonesia with less than 5% of global supply, a country that has recently hit the news due to environmental issues surrounding its surge in nickel production.

Cobalt’s current role in the EV revolution cannot be overstated. It’s a key ingredient in most of the lithium-ion battery chemistries that power EVs, prized for its ability to improve energy density and battery life. As the world continues to shift towards cleaner, more sustainable forms of energy, the demand for cobalt is expected to grow.

Over the past decade, cobalt prices have seen significant fluctuations, mirroring the ebbs and flows of the EV industry.

Prices peaked in 2018 at US$93,750/t, driven by strong demand from the battery sector and supply concerns in the DRC. However, prices have since corrected due to an oversupply in the short-term. Prices dropped to US$26,000/t in 2019, recovered to US$80,000/t in 2022 before then falling again to the current price around US$28,500/t.

Looking forward, the outlook for cobalt remains positive. The ongoing push for electrification, coupled with supply uncertainties, could drive prices higher. For investors, cobalt presents a compelling opportunity. As many countries are seeking non-Chinese supplies of critical minerals, the push is on to develop new sources of non-DRC cobalt.

There are a number of ASX-listed companies with either cobalt dominant projects as well as others where cobalt is a co- or by-product along with nickel or copper. These companies have projects at various stages of development, offering investors entry points at different levels of risk.

Recent discussions about the growth of the EV sector have moderated forecasts from 30% per annum back to around 20% per annum, still a hefty rise in anyone’s books. For this to be sustained, it will require sufficient supplies of all the commodities that make up the EV batteries, not just lithium or nickel. Expect an increased focus on cobalt plays over the coming years.

White Noise communications is provided a fee for service working with companies which may have exposure to commodities or securities mentioned in these articles. All articles are the opinion of the author and are not endorsed by, or written in collaboration with, our clients.