In the ever-shifting landscape of commodities, everyone’s on the lookout for the next big trend. In recent times, we’ve seen the meteoric rise and sudden fall in lithium, and nickel’s unfortunate plunge due to oversupply from Indonesia. Amidst the turbulence, gold and copper now dominate the headlines, with strong starts to 2024. However, tin is quietly flying under the radar and is emerging as a silent powerhouse.

Despite its historical tendency to be overshadowed by more glamorous metals, tin is proving itself to be an indispensable component in the technology revolution sweeping the globe. This importance underscored by the addition to USA’s and EU’s Critical Minerals List, while Australia has designated it as a Strategic Mineral. Currently, the tin price is sitting at USD $28,025/t, an increase of close to USD $3,000/t since the start of the new year, which can be directly correlated to the LME tin stock levels falling from 8,190t in mid-December 2023 to 4,435t currently.

Unregulated and Unreliable Supply

The current landscape of tin supply is fraught with instability, primarily stemming from unreliable jurisdictions such as Myanmar Wa State, Indonesia, Peru, and China. This dominance of uncertain sources has led to significant disruptions in the global tin market, sparking concerns about the sustainability of the supply chain.

A prime example of this volatility is evident in Myanmar Wa State, where mining activities were abruptly suspended in early August 2023. Although extraction of other commodities resumed at the start of January 2024, the ban on mining in the crucial Man Maw mine area persists. This area alone accounts for nearly all tin production in Wa State.

Adding to the uncertainty is the situation in Indonesia, a key player in the global tin market. Delays in licensing and the backdrop of presidential elections, coupled with ongoing corruption investigations, have cast a shadow over Indonesian tin production and exports. The International Tin Association reports a 99% decrease in refined tin exports from Indonesia in January, and 98% decrease in February, year on year.

Consequently, China, a major importer of tin, finds itself grappling with a feedstock squeeze due to the cessation of tin mining in Myanmar’s Wa State and the loss of Indonesian supply, which accounted for a significant portion of China’s refined tin imports in 2023.

Demand Dynamics

Tin’s demand dynamics are intricately tied to its pivotal role in semiconductor manufacturing and soldering applications. In the semiconductor industry, tin serves as a crucial material to produce frames and interconnects due to its electrical conductivity and compatibility with silicon-based materials. As the demand for advanced electronics continues to increase, driven by innovations in consumer electronics, telecommunications, and automotive technologies, the requirement for tin in semiconductor fabrication remains robust. Additionally, tin plays a vital role in soldering, where it forms the backbone of solder alloys utilized in electronic assembly processes.

Moreover, beyond its predominant use in semiconductors and soldering, tin finds application in a diverse array of industries. In the realm of renewable energy, tin is employed in the production of thin-film photovoltaic cells, contributing to the expansion of solar energy generation capacity worldwide. Furthermore, tin’s anti-corrosive properties make it an essential component in the production of coatings for steel and other metals, ensuring durability and longevity in infrastructure and construction projects.

Lack of Sustainable Tin Supply

The global battery industry is currently undergoing a major transformation, with a shift towards greener transport a welcome sight. However, it has highlighted the need for more sustainable, transparent value chains. Australian tin companies have the potential to progress and expand projects over the coming decade as a reliable supplier of tin from a Tier 1 jurisdiction.

White Noise communications is provided a fee for service working with companies which may have exposure to commodities or securities mentioned in these articles. All articles are the opinion of the author and are not endorsed by, or written in collaboration with, our clients.

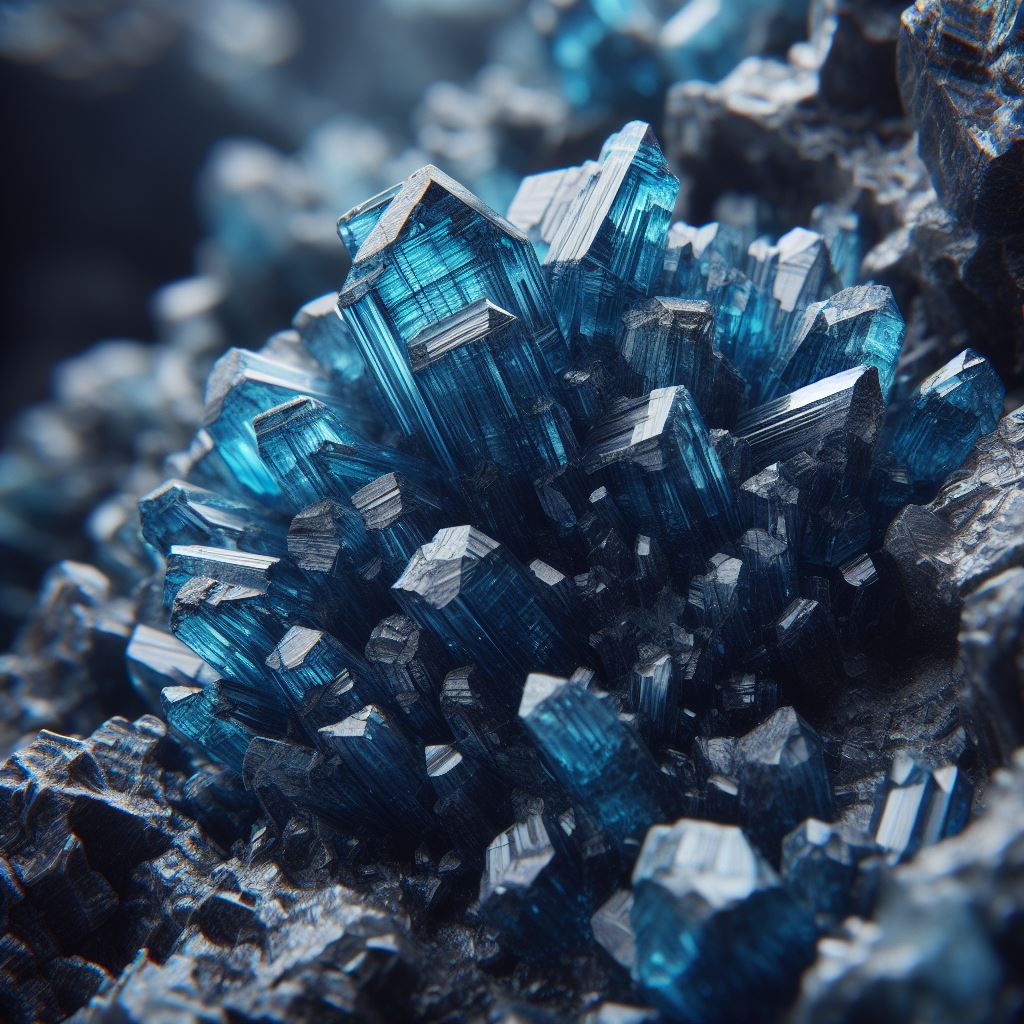

Photo by Dan Schiumarini