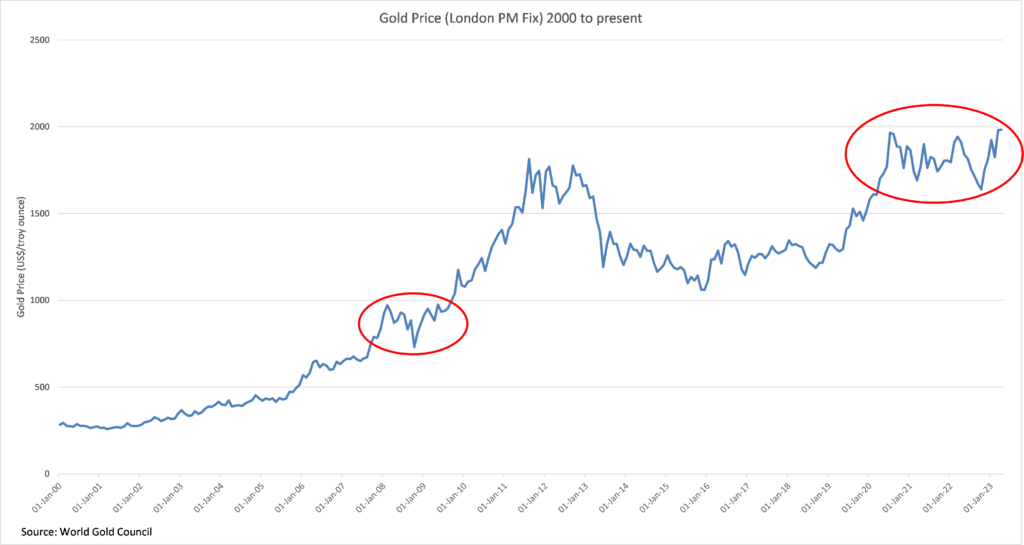

The year was 2007/2008, the Global Financial Crisis (GFC) was lurking the corridors of finance. Surely gold was headed to the moon with such a macroeconomic background? Investors poured into the precious metal, it was sure to break the significant US$1000/oz level, and it did.

Then it failed to hold the level.

Then, it ran up, and failed again, and again. Traders on the dealing floor had the stuffing knocked out of them by that stage. Gold ran a few hundred dollars below the US$1000/oz level.

The usual rumours circulated – gold was being manipulated, gold was no longer a haven in a time of crisis etc etc.

After being frequently whipsawed, many traders and investors called it a day. The GFC was shooting enough flack into the wings of traders, without doing yourself more damage playing for gold to run past US$1000, or so traders thought, and then when almost everyone on the dealing floor had walked away, gold turned, broke US$1000/oz, and kept going.

All the way to US$1800/oz.

Now 15 years later and gold is again toying with traders at another round number, this time US$2000/oz.

Three times gold has passed the US$2000/oz level and three times it has failed to hold the level, despite the dangerous macroeconomic background, despite inflation, despite US and EU bank failures.

“Gold is obviously being manipulated, no longer a haven in a time of crisis”, at least I’m sure that is what they are saying on the dealing floor.

After more than 8000 years, gold as a store of value has finally been made obsolete by a bunch of kids making up digital currencies on their computers. As of March 2023, there were 22,904 cryptocurrencies in existence. Someone should really mention, if the power or internet goes down, crypto may not look as attractive as something solid, useful and short of a nuclear war, still around in 1000 plus years.

No, crypto is not an alternative to gold, it is not even an alternative to fiat currency.

Gold’s failure to hold $2000/oz is just waiting for traders to give up and walk away, just like in 2008 when it was failing to hold US$1000/oz.

Global debt rose by US$8.3 trillion in the first three months of 2023 compared to the same period in 2022 and now stands at US$304.9 trillion. Global debt is now US$45 trillion higher than pre pandemic levels. According to Reuters Emerging, market debt recently accounted for US$100 trillion for the first time ever.

The US accounts for US$31 trillion with estimates of unfunded liabilities tipping US$200 trillion.

ASEAN members agreed this week to increase the use of local currency transactions and push for better regional payment connectivity, a move that could be seen as a continuing a shift in de-dollarization of the US Dollar in the region. (See our article on the subject in newsletter dated 14 April).

Inflation is moving slightly lower if official government figures can be believed; which they can’t. There are only two ways out of the global debt situation, default out of it, or inflate out of it. Both options look positive for gold.

Of course, they could try to pay the debt back, but that looks all but impossible. The scale of the debt is so huge that repaying it would take a lifetime and consign generations to lower standards of living. Politically, not very likely.

The point is there is enough background risk to consider holding gold while it once again toys with traders near a round number. Holding positions in gold producers with a positive future production profile looks an interesting option to hedge fiat currency and debt risk. Adjust your position size to the point you can handle if gold takes its time about breaking and holding US$2000/oz.

We have been here before, Mark Twain once said, “History never repeats itself, but it does rhyme.”

Disclosure: The writer holds positions that are long gold.

Andrew Quin is a former Macroeconomic Strategist for Australia’s largest full service stockbroker, HNW fund manager, and published Author. He holds a Masters in Mineral Economics.

White Noise communications is provided a fee for service working with companies which may have exposure to commodities mentioned in these articles. All articles are the opinion of the author and are not endorsed by, or written in collaboration with, our clients.