As we navigate through 2024, the commodity markets are presenting a mixed bag of opportunities for investors. With the global economy showing signs of both promise and peril, commodities such as gold, copper, nickel, lithium, uranium, and iron ore are at the forefront of investors’ minds. Let’s delve into the outlook for each of these commodities and what major broking houses and specialist forecasters are saying.

Gold

Gold has traditionally been the go-to asset for investors seeking a safe haven during times of economic uncertainty. In 2024, the precious metal continues to hold its allure, with investment strategies focusing on its ability to hedge against inflation and diversify portfolios.

According to JP Morgan1, the Fed cutting cycle and falling U.S. real yields are expected to push gold prices to new nominal highs in the middle of 2024, reaching an average of $2,175/oz by the fourth quarter.

Base Metals

According to Focus Economics2, softer economic growth in some key developed markets will see base metal prices average 3% lower in 2024 compared to 2023. This will be partly offset by a likely uptick in economic momentum in China—the world’s largest consumer of most base metals—with further Chinese stimulus measures a key upside risk.

The demand for copper is often seen as an indicator of economic health. With the shift towards green technologies, long-term demand for copper looks promising. However, Goldman Sachs3 notes that even though the copper market is tightening, there are still good fundamentals for copper with a forecast of US$9,200/tonne. The analysts do note there is likely to be volatility during the year associated with Chinese New Year and stockpile movements.

Among base metals, nickel has the most bearish fundamentals for 2024, with the market set to remain in large surplus for several years, driven by strong Indonesian output growth4. Despite having lower ESG credentials than other countries, there doesn’t seem to be any real penalties for consumers choosing Indonesian nickel.

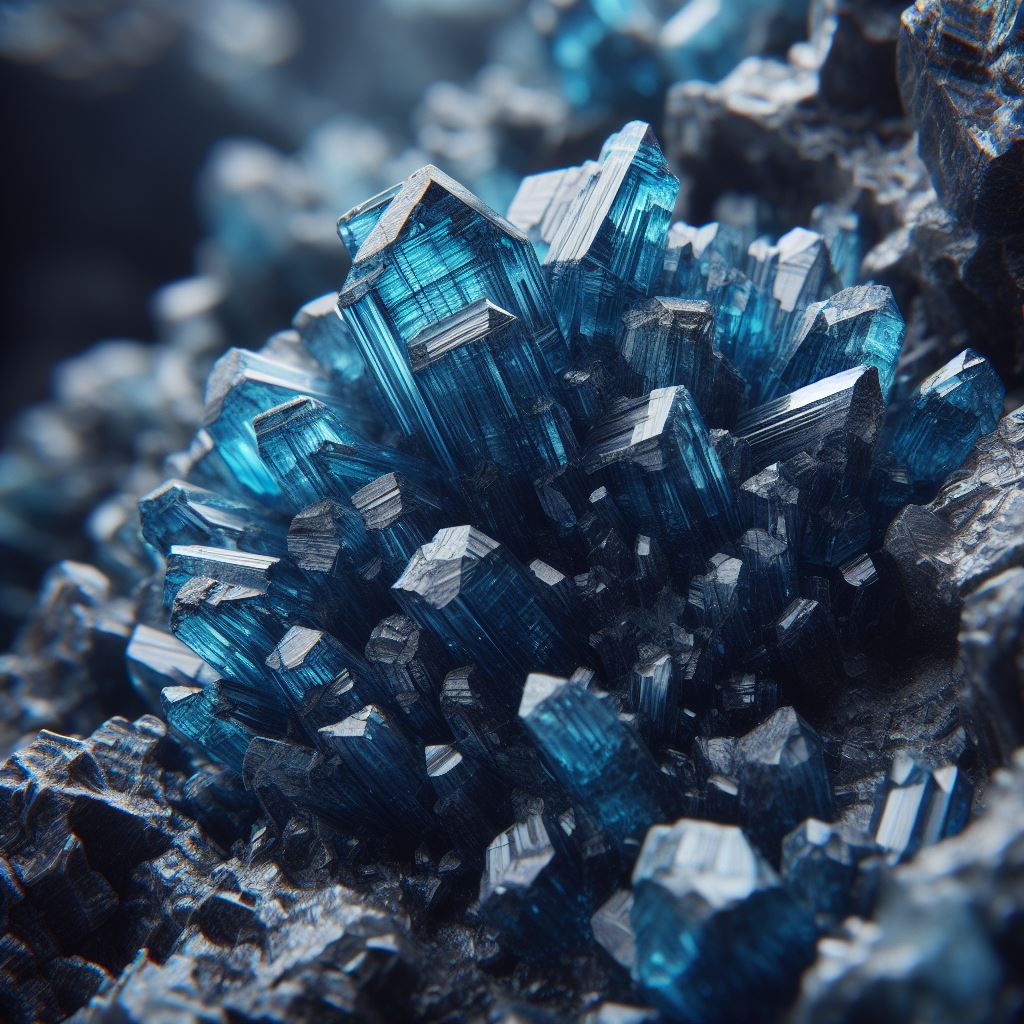

Lithium

Lithium, a critical component in the battery industry, especially for electric vehicles, is expected to see an oversupply in the short term, keeping a lid on prices. Goldman Sachs5 is seeing an oversupply of 200kt LCE, or approximately 17% of 2024 demand, which has already seen casualties with Core Lithium ceasing mining at Finniss and Albemarle scaling back expansion plans at Kemerton.

Uranium

After a decade in the doldrums, uranium is running hot at the moment, with the price increasing from about US$40/lb to over US$100/lb over the course of the last six months. Reduced production and a lack of investment has started to see buyers scrambling for supplies. At the same time, the emergence of the Sprott Uranium Trust ETF has seen a significant volume of physical product removed from the market, putting further upward pressure on prices.

In a recent note, Bank of America6 saw the Uranium price hitting US$105/lb in 2024 and US$115/lb in 2025, however given the price hit US$104/lb this week, this looks to be a formality. Highlighting the challenges of commodity price forecasting is the fact the same BoA analysts were forecasting in May last year that the yellow metal would hit US$75/lb this quarter.

Iron Ore

Iron ore’s outlook is closely tied to the construction and manufacturing sectors. Interestingly, whilst the Chinese property sector is expected to remain weak in 2024, analysts still have a positive view overall on the iron ore sector. With stimulus spending in China expected to buoy the market, ING sees the iron ore price averaging US$120/t over the course of this year3.

Conclusion

In summary, the outlook for commodity markets in 2024 is cautiously optimistic overall. Gold and uranium seem to be the standouts for the good year, whilst the nickel bulls will have to wait a bit longer for their time in the sun.

- https://www.jpmorgan.com/insights/global-research/outlook/market-outlook#section-header#4 ↩︎

- https://www.focus-economics.com/blog/our-key-commodity-forecasts-for-2024/ ↩︎

- https://marquee.gs.com/content/research/en/reports/2024/01/14/b82e9ddc-22e5-4ec5-b081-f215160018ea.html ↩︎

- https://think.ing.com/reports/commodities-outlook-2024-cautious-optimism-report ↩︎

- https://marquee.gs.com/content/research/en/reports/2024/01/12/d01a0ebc-4640-43c2-934a-ba9b5746689a.html ↩︎

- https://finance.yahoo.com/news/uraniums-third-bull-market-set-160000989.html

↩︎

Photo credit: Nimisha Mekala

White Noise communications is provided a fee for service working with companies which may have exposure to commodities or securities mentioned in these articles. All articles are the opinion of the author and are not endorsed by, or written in collaboration with, our clients.